|

Due to a history of growth through acquisition, Thomson Financial had multiple

systems that delivered the same types of information and forced customers to access

the company’s different offerings in different ways. To appear as a single

company to customers and to reduce the cost of product delivery, Thomson Financial

developed a common product delivery architecture—dubbed Thomson ONE—using

Microsoft® .NET technology. Based on a reusable set of software services and a highly

configurable desktop client, Thomson ONE solutions are helping the company enhance

user productivity, integrate more deeply with customer systems, reduce IT costs,

and accelerate time-to-market. With Thomson ONE solutions, the company can say “yes”

to customers more often, letting customers—and not internal systems—dictate

how Thomson Financial products are used.

|

We have engineered our business strategy around customer segmentation and our technology

strategy around application interoperability and integration—as achieved through

a service-oriented architecture.

|

|

|

|

Dr. Albert Hofeldt

Vice President of Technology Strategy, Thomson Financial

|

|

|

Situation

Thomson Financial is one of the largest data and analysis providers in the financial

services industry, with operations in 22 countries and 2003 revenues of U.S.$1.5

billion. The company’s diverse assets include more than 40 businesses, many

of which were acquisitions.

In the past, the company’s mode of operation was to leave newly acquired businesses

largely untouched, letting them continue to deliver the products that made them

attractive acquisitions in the first place. But the company began to reevaluate

that hands-off strategy a few years ago—driven by consolidation in its industry,

the need to minimize the cost of product development and delivery, and, most important,

constantly growing customer expectations and demand for greater value.

One area where Thomson Financial saw considerable opportunity for improvement was

in the technology infrastructure used to deliver its diverse range of products.

Those products were supported by multiple operating systems (primarily Microsoft®

Windows® and UNIX), technologies such as Java 2 Platform Enterprise Edition (J2EE)

and the Component Object Model, and early programming languages like C and Fortran.

Moving forward, the company envisioned a single, common product delivery architecture

that could support all its offerings. Key business drivers for that vision included:

- Improved user experience. To better accommodate the needs of the

financial professionals and help increase their productivity, Thomson Financial

wanted to deliver a richer and more responsive user experience. Users of the company’s

offerings do a good deal of analysis—an area where Thomson Financial delivers

significant value by providing features like customizable workspaces and advanced

charting and graphing tools.

- Deeper integration with customers. Many of the applications that

Thomson Financial used to deliver its products to customers had user interfaces

(UIs), business logic, and data stores that were tightly coupled together. Because

of this, customers who used more than one of the company’s offerings often

had to do so through multiple interfaces—which made those customers less productive

than if the same products had been accessible through a single, well-integrated

interface. In addition, the tightly coupled architecture made it hard for customers

to integrate Thomson Financial offerings into their own systems. By providing a

single, common UI for all its offerings and a way for customers to integrate those

offerings into their own systems, Thomson Financial knew that it could deliver new

customer value in the form of reduced costs, streamlined workflows, improved productivity,

and the ability to make better and faster decisions.

- Reduced infrastructure and development costs. As Thomson Financial

grew, so did the number of systems that it used to service customers. Those systems

numbered more than 100, with a good deal of overlap in terms of functionality and

with the same data stored in multiple places across the organization. Most data

stores supported multiple applications, and many of those applications had multiple

user interfaces—often cloned and customized to meet the needs of specific

customers. By reducing redundancy and serving customers with fewer systems, the

company knew it could save millions in infrastructure costs. In addition, having

fewer systems would reduce software development costs because the company would

no longer need to maintain so many applications—or develop new functionality

more than once for delivery to different customer segments

“Content providers traditionally were focused on a single [market] such as

news, research, or analytics, but industry consolidation is changing that,”

says Bill Quinn, Vice President for Product Management at Thomson Financial. “We

saw that meeting all of a customer’s needs through individual applications

was no longer enough—and began working to integrate our offerings to help

customers streamline workflows and reduce costs.”

Solution

Thomson ONE solutions, based on Microsoft .NET software, are helping the company

reduce the complexity and redundancy of its technology infrastructure and thus decrease

costs. In addition, the solutions improve the company’s ability to meet customer

needs by allowing those customers to access the broad range of Thomson Financial

products in multiple ways: through direct, programmatic integration with the customer’s

internal systems using broadly accepted Web standards; or by using a common, highly

customizable user interface that delivers the richness and responsiveness of Windows-based

desktop applications together with the deployment and manageability benefits of

Web-based solutions.

Developed with guidance from Microsoft, Thomson ONE solutions provide those capabilities

through a service-oriented architecture that consists of two primary components:

a service layer that encapsulates business functionality and exposes it

as a set of reusable Web services, and a smart client application that

programmatically accesses those services to deliver the user experience.

- Service layer. In a service-oriented architecture, the service

layer encapsulates the solution’s data store and business logic layer, exposing

their combined functionality (for example, methods of analysis on financial market

data) as Web services—discrete application components that are accessed using

standard Web protocols like XML, SOAP, and WSDL. Unlike tightly coupled solutions

in which the presentation tier must know how to access the business logic tier (in

essence, a self-service model), the means of interaction in a service-oriented architecture

is a full-service model in which a system that wants to access the service layer

must only describe to the service layer what it needs. The service layer handles

the details of fulfilling the request—for example, retrieving data from a

database and analyzing it—and delivers the desired results while hiding the

underlying complexity of servicing that request. In Thomson ONE solutions, the service

layer also provides a set of infrastructure services, such as those for user authentication

and authorization, storage of user preferences, system event logging, and application

updates.

- Smart client. A smart client is an easily deployed and managed

application that runs locally on a user’s device and intelligently connects

to distributed data sources (in the case of Thomson ONE solutions, this is done

through the service layer). By using local computing resources such as processing

power, memory, disk storage, and peripherals, the Thomson ONE smart client can deliver

a user experience that is rich, very responsive, and adaptive to the way that people

work. For example, the rendering of user interface elements like charts and graphs

is fast because those processor-intensive tasks are performed locally by the smart

client. When the smart client needs data that it does not have, it sends a message

to the service layer. The service layer replies with another message containing

the requested data, which the smart client stores locally for further analysis or

manipulation—including at times when the user is offline. Updates to the smart

client application itself are automatic—again through functionality provided

by the service layer.

For some new solutions, both the service layer and smart client are being developed

using the Microsoft Visual Studio® .NET development system and are based on the

Microsoft .NET Framework—an integral component of the Windows operating system

that provides a common programming model and runtime for developing Web services,

Web applications, and smart client applications. In other cases, a smart client

based on .NET technology connects to a solution that runs on another platform through

the use of Web services. In a third scenario, .NET technology is used to provide

a service layer in front of an existing solution, allowing it to be accessed by

either smart clients or Web-based solutions.

“We have engineered our business strategy around customer segmentation and

our technology strategy around application interoperability and integration—as

achieved through a service-oriented architecture,” says Dr. Albert Hofeldt,

Vice President of Technology Strategy for Thomson Financial. “Such a strategic

combination facilitates cross-application workflows that provide our customers with

direct efficiency gains by drastically simplifying the execution of complex business

processes.”

How It Works

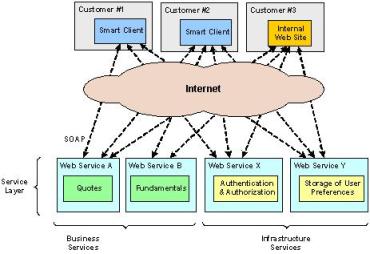

Figure 1 shows how a service-oriented architecture based on Web services can support

both smart client applications and internal Web solutions that Thomson Financial

customers might choose to build. The Web services exposed by the service layer can

be consumed by solutions running on all major platforms—a big integration

benefit. The service layer can be accessed easily by the internal systems of a Thomson

Financial customer, another Thomson Financial system, or a smart client running

on a user’s desktop PC, regardless of the platform on which the system calling

the service resides.

|

|

Figure 1. Thomson ONE solutions are built on a set of discrete Web services, which

can be accessed by a smart client or by other systems.

|

Moreover, because Web services are based on Internet standards, they can be accessed

just as easily over the Internet as through dedicated lines. (Thomson Financial

customers usually prefer dedicated lines because they value performance and reliability

over connectivity cost savings. However, even in those cases, Web services make

it easier to configure the dedicated lines and the networks that they connect.)

“In the past, a solution’s user interface was tightly tied to its business

logic,” says Joe McMenimen, Enterprise Architect at Thomson Financial. “Customers

had to take the UI that came with the solution, or we had to clone the solution

and then modify the UI, ending up with yet another system to maintain and manage.

With a service-oriented architecture, we can build a Web service once and use it

over and over again, accessing it through whichever user interface is best suited

to the needs of the customer. With its extensive support for Web services, Microsoft

.NET technology is an outstanding option for building such an architecture. As an

added benefit, we can use the same tool set and programming model to build the desktop

client that accesses the service layer.”

Proof of Concept

To validate the architecture for Thomson ONE solutions, developers and system architects

from the financial services company worked side by side with architects on the Microsoft

.NET Enterprise Architecture Team, which helps Microsoft customers use .NET technology

combined with industry best practices to solve real-world business problems.

|

Customers have been very impressed with the smart client interface and are happy

with the way it accommodates how a portfolio manager works.

|

|

|

|

Mark Pahlavan

Vice President of Development, Thomson ONE Portfolio Analytics Service, Thomson

Financial

|

|

|

During the three-month proof of concept, the combined development group took a snapshot

of data from Thomson Financial production systems and loaded it into a Microsoft

SQL Server™ 2000 database. The group developed the business logic required

to access the database and manipulate its data, exposing that functionality as a

set of three Microsoft ASP.NET–based Web services: a portfolio management

service for creating investment portfolios and specifying holdings, a research service

that exposes reports and news items, and a quantitative service that exposes such

information as earnings estimates and price-to-earnings ratios. The services ran

on the Microsoft Windows Server™ 2003 operating system and the .NET Framework.

All development was done using the C# programming language and the Visual Studio

.NET 2003 development system.

Using the same programming framework and tool set, the group also developed a smart

client that could meet the needs of Thomson Financial’s diverse and demanding

user base. Built to run on the Microsoft Windows XP Professional operating system,

the smart client provides enormous flexibility in the way that users work with data

by providing an extensible, highly customizable workspace that the user can configure

to meet his or her needs and working style.

Within the workspace are individual Thomlets, or UI elements, which can be repositioned

by the user. Each Thomlet performs a single function, such as managing the holdings

in a portfolio or displaying a graph. Thomlets that appear within the smart client,

and the Web services that they access, are controlled with configuration settings.

That means Thomson Financial can create a set of common Thomlets once and easily

combine them in different ways to meet the needs of any market segment—or

any specific customer—without having to write additional code.

Thomson ONE Portfolio

Even before the Thomson ONE architecture was finalized, Thomson Financial began

to employ its core principles. One such example is the company’s Thomson ONE

Portfolio, a portfolio performance attribution solution that uses a smart client

to access a service layer.

Development of the solution began in 2001, when the Thomson Financial business group

that owns the solution was part of Vestek, a company that Thomson Financial has

since acquired. At the time, Vestek used non-Microsoft technologies for application

development and database management—technologies that the company planned

to use to replace an existing portfolio analysis product.

|

|

Figure 2. Thomson ONE Portfolio, the company’s first smart client solution,

provides superior application responsiveness and a highly customizable user interface.

|

Originally, plans called for the new version of the product to have a Web-based

interface. That decision was based on the company’s experience with its chosen

technology at the time and the belief that it could not easily support loose coupling.

Instead, that technology forced the use of a tightly coupled, Web-based architecture

where both the Web and business logic tiers ran in the same location. The business

logic tier, in turn, would connect to a new database tier that the company was building.

By the time that Thomson Financial acquired Vestek, significant work already had

been done—work that the company did not want to discard as it transitioned

to its new common architecture. A database tier had been built, the data model had

been designed, and developers had built a replication mechanism between the solution’s

database tier and the legacy system’s flat file data store. In addition, a

good deal of work had been done at the business logic layer. However, it had become

clear to Thomson Financial that a solution based on the existing technology could

not deliver the desired user experience, nor would it help the company move toward

the loosely coupled product delivery architecture that it envisioned.

When work was scheduled to start on the presentation tier, Thomson Financial decided

to evaluate the use of Microsoft .NET technology, including its ability to support

the common product delivery architecture that the company wanted to achieve. Soon

after that decision, the company’s developers came to Microsoft to work with

the .NET Enterprise Architecture Team on the proof of concept described earlier.

After the successful proof of concept, six developers implemented the solution’s

business logic tier using Visual Studio .NET and the .NET Framework. The developers

used an Oracle data provider for .NET to access the already-completed database tier,

allowing the company to retain its existing database investment. They used the C#

language to implement the algorithms that calculate portfolio performance and exposed

that logic as a set of Web services. While one part of the group built the service

layer, three developers built the smart client—parallel development that was

facilitated by the use of Web services and a service-oriented architecture.

Several major Thomson Financial customers are using Thomson ONE Portfolio, which

the company is continuing to roll out to other customers. “Development of

Thomson ONE Portfolio using Microsoft .NET technology went fast and was an easy

transition for our developers,” says Mark Pahlavan, Vice President of Development

for the Thomson ONE Portfolio Analytics Service (TOPAS). “Customers have been

very impressed with the smart client interface and are happy with the way it accommodates

how a portfolio manager works. With Microsoft .NET technology, we’re able

to deliver a highly rich and productive user experience.”

Other Services

TOPAS, the service-layer component used by Thomson ONE Portfolio, is just one of

more than a dozen “vertical” services that Thomson Financial plans to

develop as it continues to build out its service-oriented architecture. Additional

Web services, many of which are in development or already in production, include

those for pricing, research, quantitative analysis, news, corporate information

(such as institutional holdings), calendar data (company events and conference calls),

and economic events—the last one providing an efficient way for Thomson Financial

to integrate the assets acquired through its recent purchase of CCBN.

In addition to vertical services, Thomson Financial is building the infrastructure

services that will be common to all Thomson ONE solutions. “In the past, infrastructure-related

functionality had to be coded into each application, making that functionality difficult

to reuse,” says Jon Christopher, Development Manager in the Global Segments

group at Thomson Financial. “With a service-oriented architecture, both domain-specific

and infrastructure services can be built once and reused time and time again. All

Thomson ONE end-user solutions will use the same set of domain-specific services,

as well as the same set of infrastructure services for things like user authentication,

application updates, and event logging. In all those cases, built-in features of

the Windows operating system and the .NET Framework gave us a large head start in

developing the infrastructure services, allowing us to extend existing mechanisms

that provide that functionality instead of having to build it from scratch or integrate

a third-party technology.”

Benefits

Using Microsoft .NET technology, Thomson Financial is reducing costs while meeting

market demand for a more tightly integrated—and thus more productive and cost-effective—customer

experience. “Over the past several years, we have worked to operate as more

of a single company to our customers,” says Quinn. “Development of the

Thomson ONE architecture has brought us significantly closer to that goal. We can

mix and match services to meet the unique demands of each customer segment, and

can extend those services to customers in whichever way provides them with the greatest

value: through direct integration with their own systems or through a rich user

interface that provides a consistent look and feel.”

|

By tapping into customer infrastructures once and integrating more deeply, we can

build stronger and deeper customer relationships.

|

|

|

|

Bill Quinn

Vice President, Product Management, Thomson Financial

|

|

|

Improved Ability to Meet Customer Needs

For Thomson Financial, the main benefit provided by the new architecture for product

and service delivery is an improved ability to meet customer needs. That leads to

more sales as the company competes with others in the highly demanding and technologically

savvy financial services industry. “With solutions based on a service-oriented

architecture and smart client, we can be more customer-centric,” says Quinn.

“Microsoft .NET technology is helping us be a company that listens intently

to customer needs. We can say to customers ‘Tell us about your needs and workflows’

instead of having to force the sale of rigidly defined products.”

Thomson ONE solutions are helping Thomson Financial deliver new value to customers

at all levels of the business—from the end user to the customer’s IT

department. “At the employee level, we can adapt to the way that a portfolio

manager likes to work—instead of requiring the person to adapt to the way

that our system works,” says Quinn. “At the business level, we become

easier to work with because we can integrate more easily and deeply with customers’

existing systems and workflows, which reduces their IT spending and the time it

takes them to realize new capabilities. By tapping into customer infrastructures

once and integrating more deeply, we can build stronger and deeper customer relationships.”

Greater User Productivity

Thomson ONE solutions help address its customers’ need to improve user productivity

by providing financial professionals with a single, highly customizable workspace

where they can position UI elements in whichever manner suits their working style.

Because the UI elements all run within the same smart client, they can communicate

with each other behind the scenes to further reduce the number of actions that it

takes a financial professional to perform a given task. This can translate to improved

business performance —for example, by helping a portfolio manager discern

and act on a new trend faster than the rest of the market.

“Our use of smart client technology for the Thomson ONE Portfolio product

has allowed us to take what were static Web reports and expose them via a highly

interactive interface, increasing the value of the data to our clients,” says

Quinn.

Thomson ONE solutions also can drive productivity gains through better performance—in

part due to a division of work between the service layer and the smart client. As

an example, Thomson ONE Portfolio can analyze portfolio performance against the

S&P 500 index over a one-year period in just 20 seconds—a calculation

that used to take 50 minutes with the previous system.

Faster, Deeper Integration with Customer Systems

Thomson Financial’s new research service, now in beta testing, is a good example

of the integration benefits provided by a service-oriented architecture. The Web

service, which exposes data from several back-end Thomson Financial systems, is

being consumed directly by the J2EE-based systems of a large portfolio management

company.

“We gave them the WSDL file that defines our service interface, and they integrated

our research service with their intranet in three weeks,” says Christopher.

“This was a new customer—one that we could not have serviced had that

customer been forced to take our user interface along with the data. The integration

capabilities provided by our new service-oriented architecture also are generating

strong interest from several other potential clients.”

Increased Sales

By helping Thomson Financial put forth a stronger value proposition and differentiate

itself from the competition, Thomson ONE solutions are helping the company win new

business. Several companies now using Thomson ONE Portfolio are new customers—companies

whose business was contingent on the delivery of a smart client solution instead

of one with a Web-based interface.

“Our new product delivery architecture has absolutely helped us in the market,”

says Quinn. “We already have had a few tremendous wins—deals that we

have won based on our increased solution flexibility. When clients are presented

with the Thomson ONE vision, they immediately see that it is exactly what they need

and that it will help them drive business performance and reduce costs. Our ability

to provide a solution mix of rendered content plus direct access to our research

Web service has helped us displace a major competitor at a client. In addition …

our services-based approach has allowed us to repurpose the Thomson ONE Portfolio

functionality for our Baseline [investment management solution], which gives us

immediate access to an installed base of more than 12,000 user firms.”

|

Our new product delivery architecture has absolutely helped us in the market. We

have already had a few tremendous wins—deals that we have won based on our

increased solution flexibility.

|

|

|

|

Bill Quinn

Vice President, Product Management, Thomson Financial

|

|

|

Faster Time-to-Market

The common architecture that supports all Thomson ONE solutions helps Thomson Financial

accelerate time-to-market for new customer solutions. Customized offerings no longer

require extensive custom development but instead can be created by mixing and matching

the smart client’s reusable UI components and the Web services that they consume.

“Our development and release cycles for Thomson ONE Portfolio have improved,”

says Quinn. “We have gone from one release every 12 months to three scheduled

releases per year.”

“No Thomson Financial group can completely facilitate all its own customer

needs,” says Quinn. “In the past, we had to build what we needed ourselves

or hook into existing systems—and even then there were issues with entitlements,

integration, and software maintenance. With a common architecture for all smart

client components, we can better leverage what other groups build instead of having

to copy and then modify it to meet our needs. Of 10 UI features, I expect that we

will be able to reuse 9 [existing features] after our component catalog is built.

For that tenth one, we will be able to develop a richer level of functionality because

we will be able to better focus our resources.”

The same software reuse benefits hold true for the service layer, which employs

a common architecture and a repeatable infrastructure pattern. Infrastructure services

common to all Thomson ONE solutions need to be built only once and can be used over

and over again—with any changes to those services made in a single place and

immediately becoming accessible to all systems that rely on that service.

One such example is the user authentication and permissioning service for Thomson

ONE Portfolio, which today uses an Oracle database to store user information and

permissions but soon will transition to the Active Directory® directory service

in Windows Server 2003, which is the foundation of Microsoft Windows Server System™

integrated server software. Thomson Financial will integrate the service layer with

Active Directory once, and the capabilities provided by Active Directory will become

accessible to all users—without the need to modify each individual system

that accesses the service. Because the Web service abstracts the specific technology

and implementation that it exposes, the systems that access that Web service should

require no changes at all.

Thomson Financial also is achieving faster time-to-market through improved developer

productivity—due in large part to the extensive prebuilt functionality in

the .NET Framework and the Visual Studio .NET integrated development environment.

“With Visual Studio .NET and the .NET Framework, we get a single programming

framework and tool set that can support both service layer and smart client development,”

says Christopher. “Our productivity has gone up quite a bit since we moved

to .NET, and we no longer continually stop to integrate. In addition, we now enjoy

greater flexibility in the allocation of resources. If one developer goes on vacation,

it’s easier to find someone who can cover for that person because we are all

using the same tool set.”

|

When clients are presented with the Thomson ONE vision, they immediately see that

it is exactly what they need and that it will help them drive business performance

and reduce costs.

|

|

|

|

Bill Quinn

Vice President, Product Management, Thomson Financial

|

|

|

Reduced Costs

Improved software reuse and developer productivity, reduced infrastructure complexity,

and fewer systems and applications to maintain all are helping Thomson Financial

minimize its costs. In addition, the transition from Web-based solutions to ones

based on a smart client—where the processing workload is shared with the user

desktop—is reducing the workload placed on the company’s data centers,

allowing Thomson Financial to service its customer base with less hardware. Similarly,

because the service layer and smart client communicate at a programmatic level instead

of rendering the user interface on Web servers and then sending it to a Web browser,

the company benefits from decreased bandwidth usage.

The new product delivery architecture also is helping Thomson Financial reduce the

cost and complexity of deploying software updates. Capabilities built into the service

layer and smart client let the company update the smart client after it has been

installed on user desktops by putting the new software on centralized servers—in

much the same way that software updates are done in a Web-based solution but without

limiting the richness of the user experience. In addition, capabilities of the .NET

Framework help the company deploy new service-layer business logic with significantly

less effort than in the past.

“With Microsoft .NET technology, updates to the service layer or the smart

client are almost as simple as dropping new files into a directory on the server,”

says Pahlavan. “The process takes minutes and is so straightforward that we

no longer need to be involved, which leaves my team with more time to build new

functionality in support of the business.”

For More Information

For more information about Symbyo products and services, call the Symbyo Sales Information

Center at 1.877.4.796296 .

For more information about Thomson Financial products and services, visit the Web

site at:

www.thomson.com

This case study is for informational purposes only. SYMBYO MAKES NO WARRANTIES,

EXPRESS OR IMPLIED, IN THIS SUMMARY.

Microsoft, Active Directory, Visual Studio, Windows, Windows Server, and Windows

Server System are either registered trademarks or trademarks of Microsoft Corporation

in the United States and/or other countries. All other trademarks are property of

their respective owners.

Top of page

Top of page

|

|

Solution Overview

http://www.thomson.com/financial

Customer Size: 9300 employees

Organization Profile

New York, New York–based Thomson Financial is one of the largest data and

analysis providers in the financial services industry, with 7,700 employees in 22

countries and 2003 revenues of U.S.$1.5 billion.

Business Situation

To better meet customer needs and reduce the complexity of its IT infrastructure,

Thomson Financial wanted to standardize on a single, highly flexible product delivery

architecture.

Solution

Thomson ONE solutions, built using various technologies including Microsoft® .NET,

employ a common, reusable set of software services that are accessed through a configurable

desktop application.

Benefits

- Improved ability to meet customer needs

- Greater user productivity

- Faster, deeper integration with customer systems

- Increased sales

- Faster time-to-market

Software and Services

Microsoft .NET

Microsoft .NET Framework

Microsoft SQL Server 2000

Microsoft Visual Studio .NET 2003

Microsoft Windows Server 2003 Enterprise Edition

Vertical Industries

Asset Management

Banking Industry

Investment Management and Advise

Country/Region

United States

|